WASHINGTON - The US Federal Reserve cut its key lending rate by half a percentage-point Wednesday in its first reduction for more than four years, sharply lowering borrowing costs shortly before November's presidential election.

The Fed's decision will affect the rates at which commercial banks lend to consumers and businesses, bringing down the cost of borrowing on everything from mortgages to credit cards.

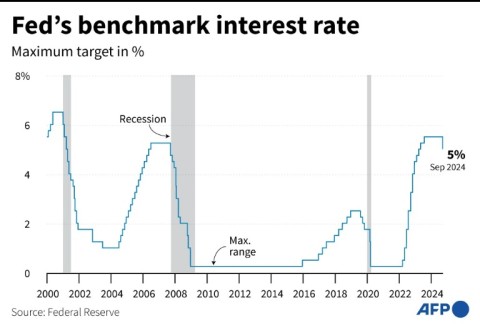

The move marks the beginning of the end of the Fed's high interest rate environment aimed at throttling demand, with inflation now easing towards the central bank's long-term two-percent target and the labor market continuing to cool amid a surprisingly resilient post-Covid economy.

Against this backdrop, Wednesday's large Fed rate cut is probably good news for Democratic presidential candidate and US Vice President Kamala Harris, who is running against Republican former president Donald Trump in the upcoming election.

"While this announcement is welcome news for Americans who have borne the brunt of high prices, my focus is on the work ahead to keep bringing prices down," Harris said in a statement.

At an event in New York on Wednesday, Trump told reporters that the independent US central bank's decision was either a response to a "very bad" economy, or it had been "playing politics."

"But it was a big cut," he added.

Major US stock indices finished lower following the Fed's decision.

Policymakers voted 11-to-1 in favour of lowering the central bank's benchmark rate to between 4.75 percent and 5.00 percent, the Fed announced in a statement.

They also penciled in an additional half-point of cuts before the end of this year, and an added percentage-point of cuts in 2025.

"It is time to recalibrate our policy to something that is more appropriate, given the progress on inflation, and on employment moving to a more sustainable level," Fed Chair Jerome Powell told reporters after the decision was announced.

"This is the beginning of that process," he added.

Analysts had widely expected the Fed to reduce rates on Wednesday, but were uncertain if it would cut by 25 basis points or 50.

A smaller cut would have been a more conventional step, while the larger move does more to stimulate demand, but also carries a greater risk of reigniting inflation.