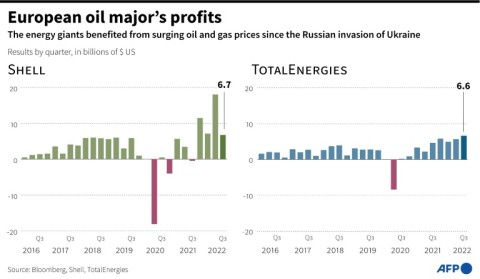

British energy giant Shell on Thursday announced net profit totalling $6.7 billion in the third quarter, as oil and gas prices remain strong despite recent slides on easing supply fears.

The result compared with a loss after tax of $447 million in the July-September period last year, Shell said.

Flush with cash from revenue surging to almost $100 billion, Shell said it would buy back shares at a cost of $4 billion.

"We are delivering robust results at a time of ongoing volatility in global energy markets," said Shell's outgoing chief executive Ben van Beurden.

The latest profit, however, was far lower than its second-quarter net income of $18 billion.

Shell alerted the market on the comparison earlier this month, blaming the drop on a slump in refining margins.

Although oil and gas prices have surged from a year ago following the invasion of Ukraine by major energy producer Russia, hydrocarbon values have seen some recent cooling as the northern hemisphere experiences mild temperatures and countries shore up supplies.

- Shares rally -

Shell's share price jumped 3.5 percent following the results, which also included a raised dividend following underlying profits ahead of analyst expectations.

The group's latest earnings reignited calls for the UK government to slap a much bigger windfall tax on energy companies as millions of Britons struggle with a cost-of-living crisis.

"A proper tax on Shell's reported Q3... profits as well as the billions made in Q1 and Q2 by all the fossil fuel giants would already have generated enough cash to insulate thousands of homes," Greenpeace UK's senior climate advisor Charlie Kronick said.

"Responding to the cost-of-living crisis is well within the government's control."

Britain's new prime minister, Rishi Sunak, unveiled a windfall tax on the profits of British energy companies earlier this year in his role as finance minister, but it was deemed as far too small by campaigners.

Van Beurden recently indicated that governments should "probably" tax energy firms more to help protect the poorest from rocketing energy bills amid decades-high inflation, although critics said the comments did not carry much weight ahead of his departure.

Shell last month announced that van Beurden would step down as CEO at the end of the year, as the energy major looks to reinvent itself under group renewables boss Wael Sawan.

Towards the end of his nine years at the helm, van Beurden slashed thousands of jobs after Shell slumped into a huge loss on Covid lockdowns.

A Shell veteran with almost 40 years at the group, he departs having carried out a major corporate overhaul that saw the company ditch "Royal Dutch" from the start of its name.