UNITED STATES - US and European stock markets rose but bank shares wavered in volatile trading on Monday after financial authorities scrambled to ease fears of a crisis in the banking system.

UBS agreed to take over Credit Suisse for $3 billion Swiss francs ($3.25 billion) in a government-brokered deal on Sunday following days of market upheaval over the health of the banking sector.

Hours later, the US Federal Reserve and other major central banks announced a coordinated effort to improve banks' access to liquidity.

European indices and Wall Street rose in choppy trading as investors remain on edge, a week after US authorities stepped in to prevent bank runs following the collapse of US regional lenders.

Asian markets closed in the red.

"This is now the second weekend that central banks, governments, and regulators have spent putting out fires," said Craig Erlam, analyst at OANDA trading platform.

"While markets are recovering today, I'm not sure anyone is confident that all flames have been extinguished," Erlam said, adding, however, that the speedy and decisive reaction of authorities will provide "some reassurances amid all of the uncertainty".

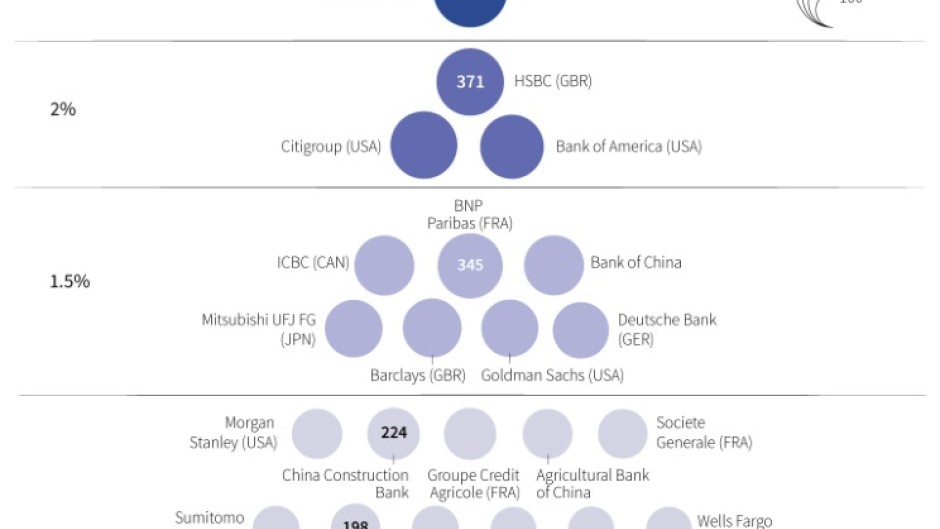

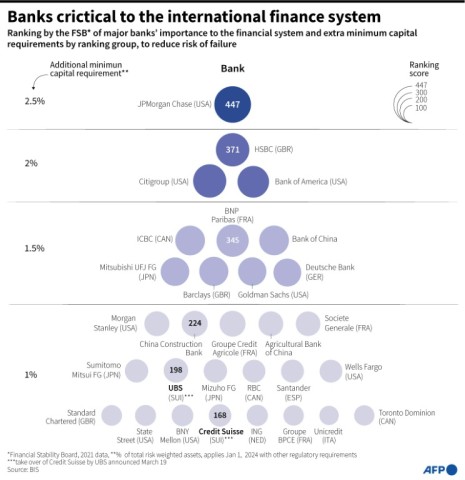

Investors pored overed the Credit Suisse buyout, which sought to prevent a wider crisis as the Swiss bank is among 30 global banks considered "too big to fail".

After the US banking woes, Credit Suisse shares went into freefall last week over fears it was the next domino to fall. Credit Suisse was already shaken by other scandals, including its exposure to the 2021 collapses of investment firms Archegos and Greensill.

The buyout "may have some effect in reducing anxiety levels in financial markets, but it may only be short-lived, with traders left wondering which bank could be next to hit the headlines for all the wrong reasons," said Tim Waterer, analyst at Kohle Capital Markets.

One concern from Sunday's deal was the effect it could have on the high-risk debt market as holders of such bonds at Credit Suisse, known as AT1s, will lose $17.3 billion after authorities required that they be written off.

AT1 or "CoCo" bonds, which offer high returns but also carry high risks, were created following the 2008 global financial crisis to put the burden of losses on investors instead of taxpayers.

- 'Strong' reaction -

Officials sought to reassure the markets.

EU Economy Commissioner Paolo Gentiloni said the reaction of "monetary authorities has been strong and rapid".

European Central Bank president Cristine Lagarde said the capital buffers and liquidity of eurozone banks were "way in excess" of what is required while their exposure to Credit Suisse's AT1 bonds was "very limited".

The sector's Stoxx Europe 600 Banks index rose 1.3 percent after trading in the red earlier in the day, but some banks fared better than others.

UBS shares rose after dropping sharply at the open. Credit Suisse fell more than 55 percent after paring down losses.

British banks Standard Chartered and Barclays fell but French giant BNP Paribas and Germany's Commerzbank were up.

On Wall Street, shares in US banking giants JPMorgan Chases and Bank of America rose but Citigroup fell.

Troubled First Republic Bank's stock price continued its decline, plunging more than 30 percent even though a coalition of US lenders injected $30 billion into their peer last week.

The collapse this month of US regional lenders Silicon Valley Bank, Signature Bank and Silvergate sparked fears of contagion as worried customers withdrew cash.

It led US authorities last week to promise support for other lenders and depositors.

Investors will focus on the Fed's monetary policy meeting this week, with speculation mounting that it will pause its interest rate hikes to provide some stability to markets.

Silicon Valley Bank took a big financial hit as the value of its bond portfolio fell due to the rising rates.

- Key figures around 1700 GMT -

New York - Dow: UP 1.1 percent at 32,217.09 points

London - FTSE 100: UP 0.9 percent at 7,403.85

Frankfurt - DAX: UP 1.1 percent at 14,933.38

Paris - CAC 40: UP 1.3 percent at 7,013.14

EURO STOXX 50: UP 1.3 percent at 4,119.42

Tokyo - Nikkei 225: DOWN 1.4 percent at 26,945.67 (close)

Hong Kong - Hang Seng Index: DOWN 2.7 percent at 19,000.71 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,234.91 (close)

Euro/dollar: UP at $1.0724 from $1.0671 on Friday

Pound/dollar: UP at $1.2269 from $1.2174

Euro/pound: DOWN at 87.40 pence from 87.59 pence

Dollar/yen: DOWN at 131.59 yen from 131.80 yen

West Texas Intermediate: DOWN 1.6 percent at $65.88 per barrel

Brent North Sea crude: DOWN 1.3 percent at $72.02 per barrel