BEIJING - Asian markets fluctuated as traders weighed a range of issues including US debt ceiling hopes, high-level talks between Washington and Beijing, banking sector uncertainty and more signs of a slowing economy.

Investors hoping the Federal Reserve will finally take a breather from its long-running campaign of interest rate hikes have been left feeling a little more confident this week after data showed inflation on both a consumer and wholesale level continued to ease in April.

Their hopes were given a further boost Thursday by news that jobless claims last week hit their highest since October 2021, suggesting the labour market was showing some slack.

The Fed has long said it needed to see a softening in employment as well as a drop in inflation before it could consider ending its rate hike drive and look at a potential cut in borrowing costs.

"US economic data overnight continued the theme of tentative signs of a softening labour market and room for optimism about the inflation outlook," said National Australia Bank's Taylor Nugent.

"Caution on one week’s claims number is always well advised, but the incremental signal looks to be a more compelling trend higher."

US-listed Chinese firms performed well in New York, with tech firms also helped by a strong earnings report from ecommerce giant JD.com. And the rally continued for the sector in Hong Kong, with JD.com up more than seven percent and rival Alibaba almost three percent higher.

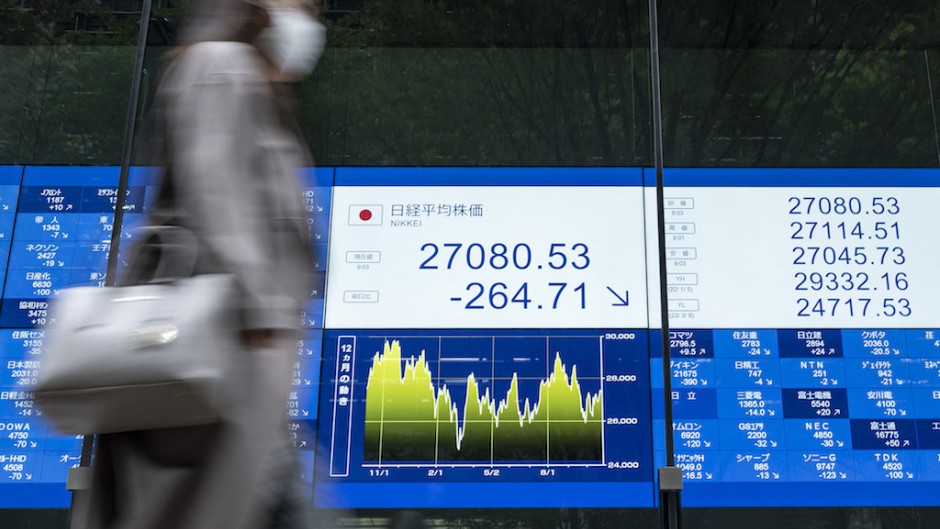

The gains lifted the city's Hang Seng Index, while there were also gains in Tokyo and Wellington.

But Shanghai, Sydney, Seoul, Singapore and Taipei were in negative territory.

The losses followed another tepid lead from Wall Street, where the Dow and S&P 500 ended down as fears over the banking sector continued to weigh.

US regional lenders came under fresh pressure after PacWest noted in a filing that media reports that it was exploring strategic options had sparked a surge in withdrawals from worried customers.

It said total deposits dived almost 17 percent in the first quarter, when the finance industry was rocked by the collapse of three local banks.

Eyes are also on Washington, where much-anticipated debt ceiling talks between President Joe Biden and Republican leaders were postponed until next week, with sources saying staff-level discussions were progressing.