BEIJING - Asian markets mostly rose on Monday but traders remained on edge as they considered the prospect of more US interest rate hikes aimed at bringing down stubbornly high inflation.

Equities have struggled to build on January's rally, with recent data showing that the Federal Reserve still had plenty of work to do to get prices under control.

Investors are now awaiting the release of minutes from the central bank's most recent policy meeting, hoping to gauge officials' views on their next steps.

Sentiment was given a jolt last week by comments from some members who said they were open to a 50-basis-point hike at the next gathering.

Several others have already warned that borrowing costs would likely have to go higher and stay there for longer to tame inflation, which has eased but remains elevated.

That has renewed concerns that the world's top economy could tip into recession, with commentators warning earnings will also take a hit.

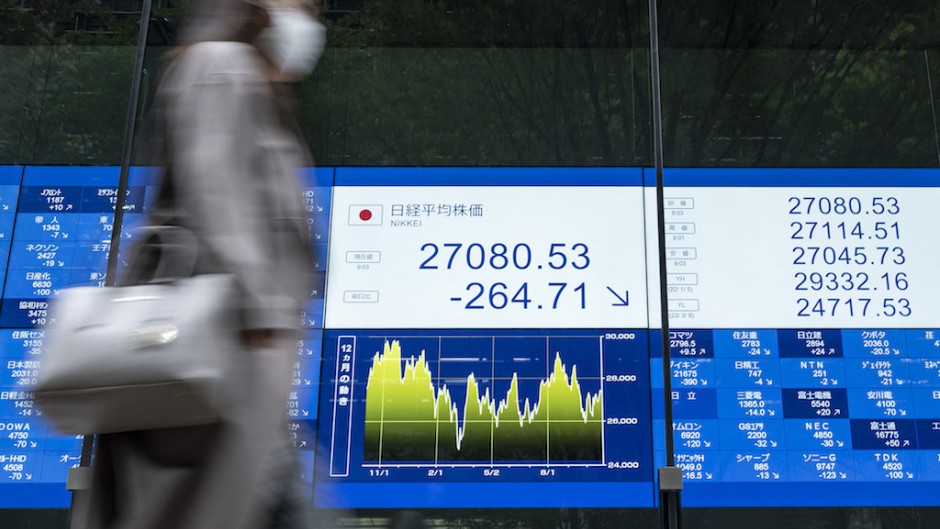

Asian markets fluctuated following a mixed day on Wall Street on Friday.

Shanghai led gains, jumping more than two percent as banking giant Goldman Sachs said it saw mainland Chinese stocks surging this year as the country reopens from zero-Covid and economic activity kicks on.

"The growth impulse should be heavily tilted towards the consumer economy, where (the) services sector is still operating significantly below the 2019 pre-pandemic levels," strategists at the bank said.

Hong Kong, Tokyo, Seoul, Sydney, Bangkok and Taipei rose though Mumbai, Singapore, Manila, Jakarta and Wellington fell.

Analysts warned that while traders expect further rate hikes, there could be more bad news down the line.